doordash mailing address for taxes

BUSINESS ADDRESS EIN 462852392 An Employer Identification Number. 901 Market Suite 600 San Francisco CA 94103.

Doordash 1099 How To Get Your Tax Form And When It S Sent

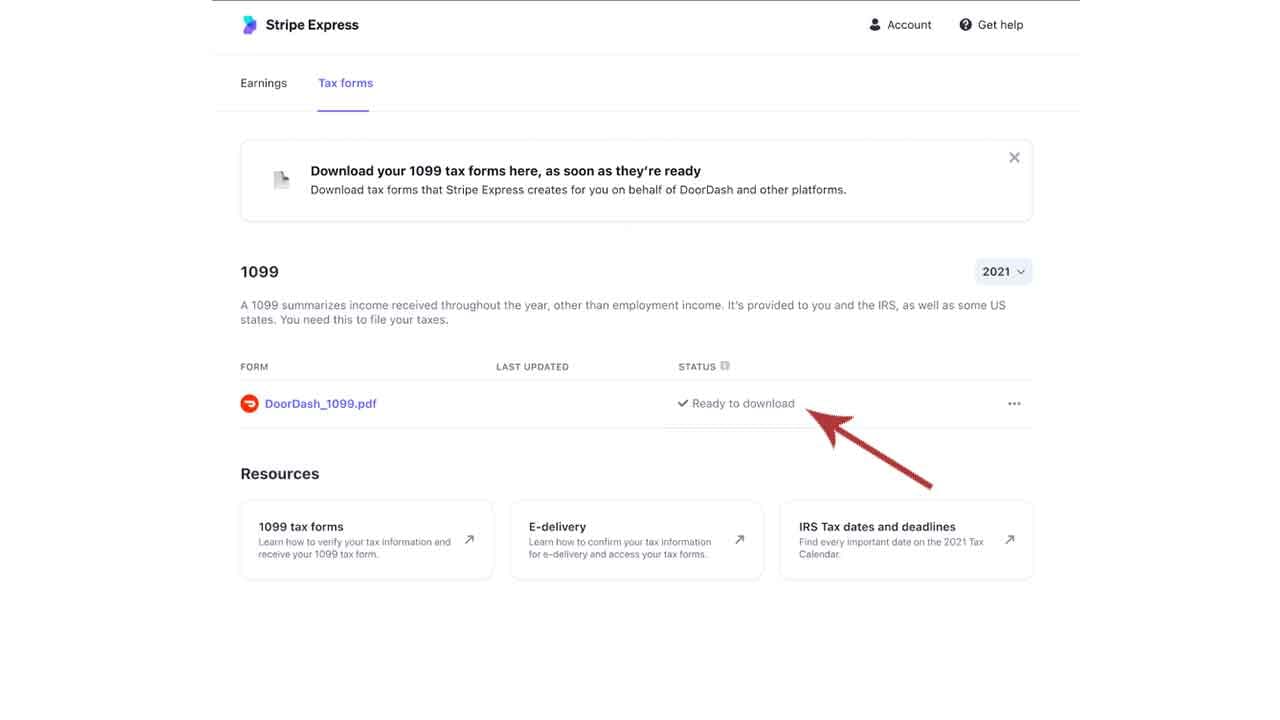

DoorDash will provide its earnings and that earnings will be presented on the 1099-NEC form.

. Internal Revenue Service IRS and if required state tax departments. March 18 2021 213 PM. Paper Copy through Mail.

Call Us 855-431-0459 Live chat. 6 rows Doordash Inc. A 1099-NEC form summarizes Dashers earnings as independent.

This means that DoorDashers will get a 1099-NEC form from DoorDash. 1 Best answer. It may take 2-3 weeks for your tax documents to arrive by mail.

The forms are filed with the US. You will simply need your 1099-NEC form which as stated earlier DoorDash will usually automatically send to you well in advance of tax filing time. You are considered as self-employed and in IRS parlance are operating a business.

If youd like to speak to a merchant sales representative you can contact us online or call us Monday-Friday. Yes - Just like everyone else youll need to pay taxes. Mailing Address Line 2 City.

You should select a delivery preference at. Add up all of your income from all sources. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US.

With the standard deduction option. It doesnt apply only to. IRS EIN Taxpayer Id 46-2852392.

If you have any 1099-specific questions we recommend reaching out to. Mailing Address Line 1 Address Line 2. DoorDash currently sends their.

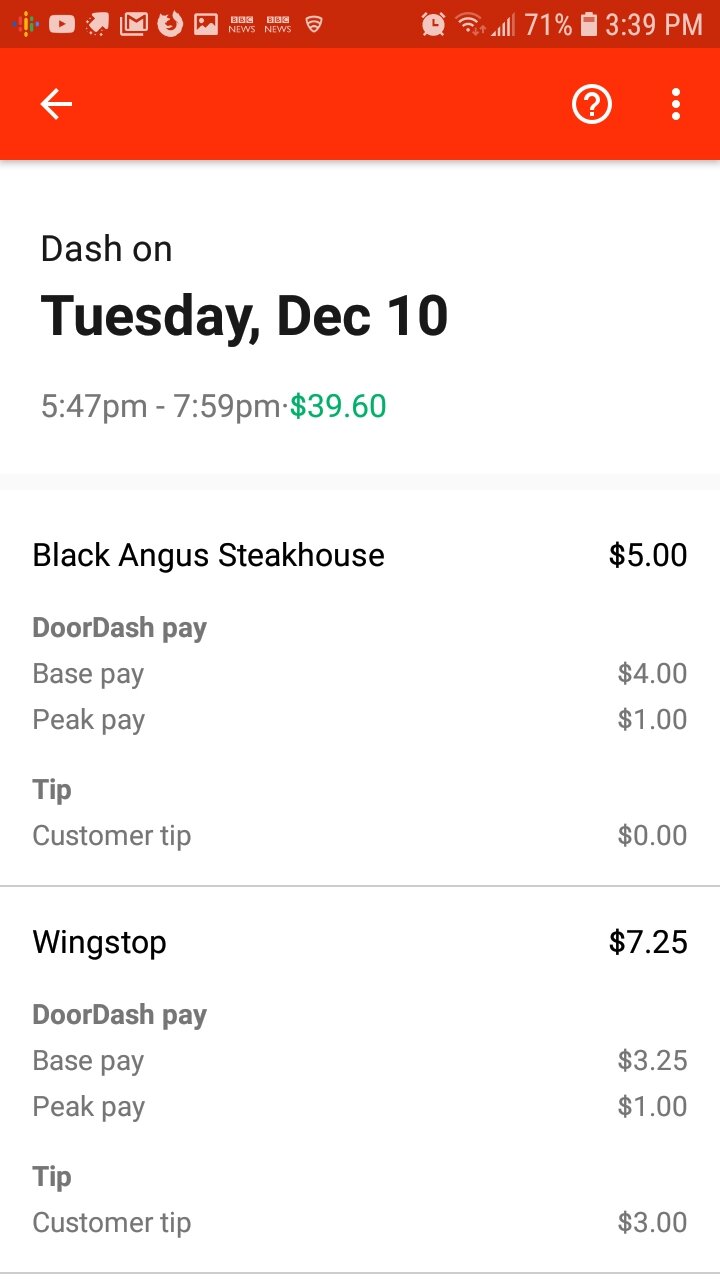

Its provided to you and the IRS as well as some US states if you earn 600 or more in 2022. If you earned more than 600 while working for DoorDash you are required to pay taxes. Doordashs platform has an Earnings tab where you can review your weekly and monthly earnings.

United States and Canada. Calculate your income tax. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash.

The rate from January 1 to June 30 2022 is 585 cents per mile. If you did not select your delivery option by 122 then Doordash will automatically mail your 1099-NEC to the address on file by February 1st and. SOUTH TOWER 8TH FLOOR.

There are four major steps to figuring out your income taxes. Tap on Tax Form Delivery to choose the desired form of the 1099 form delivery. Income from DoorDash is self-employed income.

Reduce income by applying deductions. The Doordash mileage deduction 2022 rate is 625 cents per mile starting from July 1. This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes.

Scroll down to find the Verification Tax Info section.

Do 1099 Delivery Drivers Need To Pay Quarterly Taxes Entrecourier

How To File And Take Care Of Your 1099 Doordash Taxes

No Free Lunch But Almost What Doordash Actually Pays After Expense Payup

A Complete Study Of Doordash Business Model Revenue

Form 1099 Nec For Nonemployee Compensation H R Block

Tips For Filing Doordash Taxes Silver Tax Group

Doordash How It Works Pricing How To Use And More 2022

462852392 Ein Tax Id Doordash Inc San Francisco Ca Employer Identification Number Registry

Doordash Taxes Schedule C Faqs For Dashers Courier Hacker

Doordash Introduces Ultra Fast Grocery Delivery Providing Busy Consumers With A Reliable And Convenient Way To Restock Instantly

How To Get Your 1099 Tax Form From Doordash

Doordash Reviews 2022 Details Pricing Features G2

Doordash 1099 Taxes A Guide To Filing Taxes And Maximizing Deductions

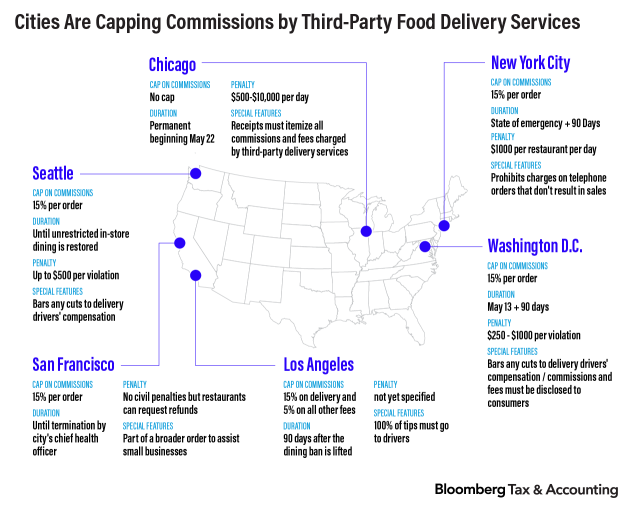

Audit Risks Emerge For Doordash Grubhub And Uber Eats

How To Become A Doordash Driver Doordash Driver Requirements Hyrecar

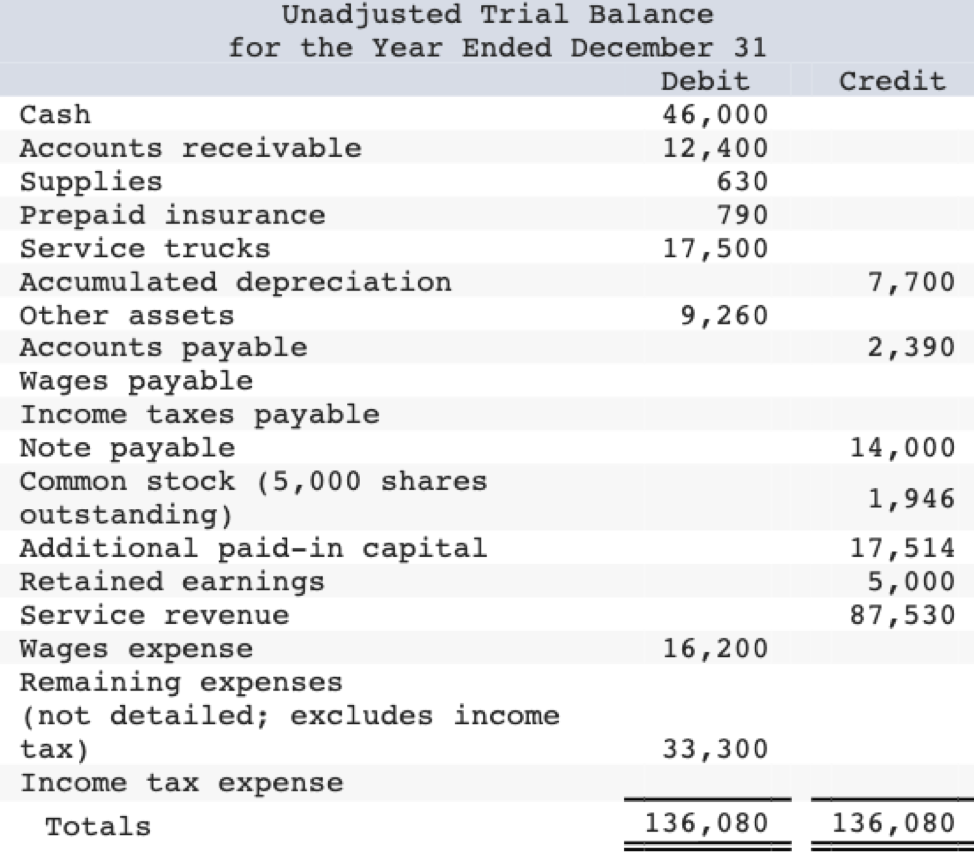

Solved Doordash Hired An Outside Accountant To Prepare The Chegg Com

How Much Do You Pay In Taxes Doordash Reddit Lifescienceglobal Com

St Louis Based Grocery Chain Dierbergs Expands Delivery Options With Doordash St Louis Business Journal