are charitable raffle tickets tax deductible

Raffle tickets are not deductible as charitable contributions for federal income tax purposes. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

Are Charitable Donations Tax Deductible

The IRS has determined that purchasing the chance to win a prize has value that.

. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. Raffle tickets are not deductible as charitable contributions for federal income tax purposes. If the organization fails to.

For 2020 the charitable limit was. 300 per tax unit. The reason why many taxpayers assume that nonprofit raffle tickets must be tax-deductible is that charitable donations to verified organizations can be deducted from your.

You cant deduct as a. Are raffle tickets for a nonprofit tax-deductible. Also if the amount of your contribution depends on the type or size of apartment you will occupy it isnt a charitable contribution.

Meaning that those who are married and filing jointly can only get a 300. The answer depends on a few factors including the value of the tickets and the purpose of the raffle. Generally if the raffle is for a charitable purpose and the tickets are.

Costs of raffles bingo lottery etc. Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by. So can i deduct the money for the tickets as a.

Withholding Tax on Raffle Prizes Regular Gambling Withholding. This is because the purchase of raffle. An organization that pays raffle prizes must withhold 25 from the winnings and report this.

Charity Auctions Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over. To get the deduction you must file Form 1040 the form. What about raffle tickets.

The charitable donation deduction allows you to lower your taxable income for donations or gifts to qualified tax-exempt organizations. A raffle ticket according to the IRS is a contribution from which you. The IRSs tax laws on charitable contributions and gambling losses are complicated.

What is the limit on charitable deductions for 2020. Is it possible to deduct a raffle ticket. The IRS has determined that purchasing the chance to win a prize has value that is.

The cost of a raffle ticket is not. Are fundraisers tax deductible. Because of the possibility of winning a prize the cost of raffle tickets you purchase at the event arent treated the same way by the IRS and are never deductible as a charitable.

The IRS has determined that purchasing the chance to win a prize has value that is essentially. Porte Brown answers the most common questions regarding charitable contributions. Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

50 50 Raffle Chester County Community Foundation S Blog

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

Are Raffle Tickets Tax Deductible The Finances Hub

Are Nonprofit Raffle Ticket Donations Tax Deductible

Are Nonprofit Raffle Ticket Donations Tax Deductible

Are Raffle Tickets Tax Deductible The Finances Hub

Nonprofit Raffles State Of California Department Of Justice Office Of The Attorney General

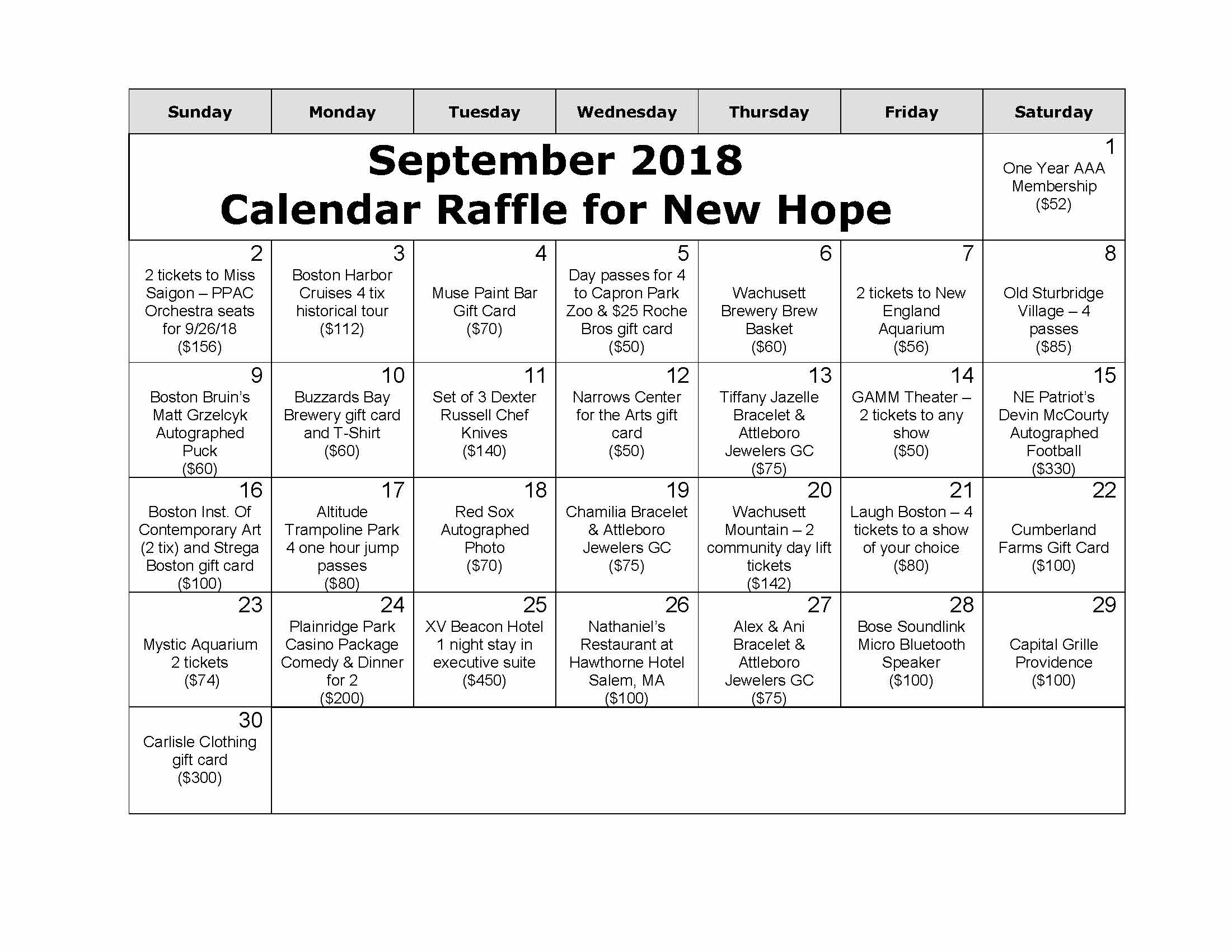

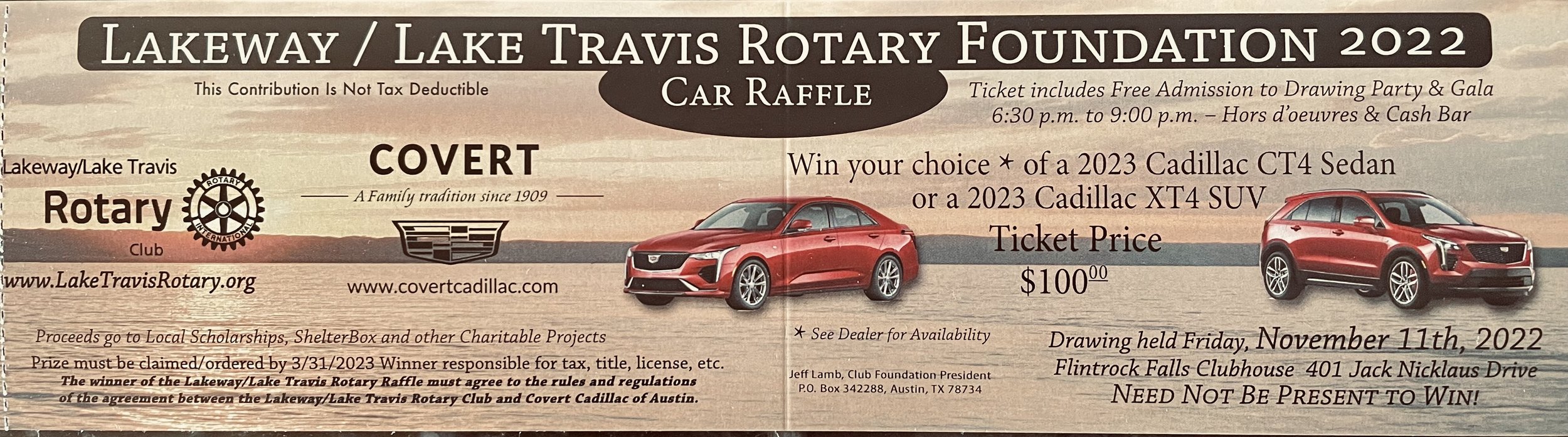

Raffle Rotary Club Of Austin Westlake

Mane Stream 50 50 Raffle Tickets Now On Sale

Are Raffle Tickets Tax Deductible The Finances Hub

2022 Ford Maverick Lariat Hybrid Five Raffle Tickets Kxci

New Tax Law Means Your Year End Charitable Contributions Are Probably No Longer Tax Deductible

Charitable Deductions On Your Tax Return Cash And Gifts

The Loudoun Education Foundation Golf Classic Loudoun Education Foundation

How Large Are Individual Income Tax Incentives For Charitable Giving Tax Policy Center

Fundraising Events And Cause Related Marketing Pdf Free Download